How to attract an all-cash offer for your NYC property

- Work with a broker who can tap relationships with wealth managers and brokers with affluent clients

- Buyers looking for an investment property may be more attracted to condos that they can rent out

- A good broker should be looking to secure all types of offers, not just all-cash deals

Soliciting only cash offers could be a red flag to buyers.

iStock

New York City’s sales market is flush with cash—offers that is.

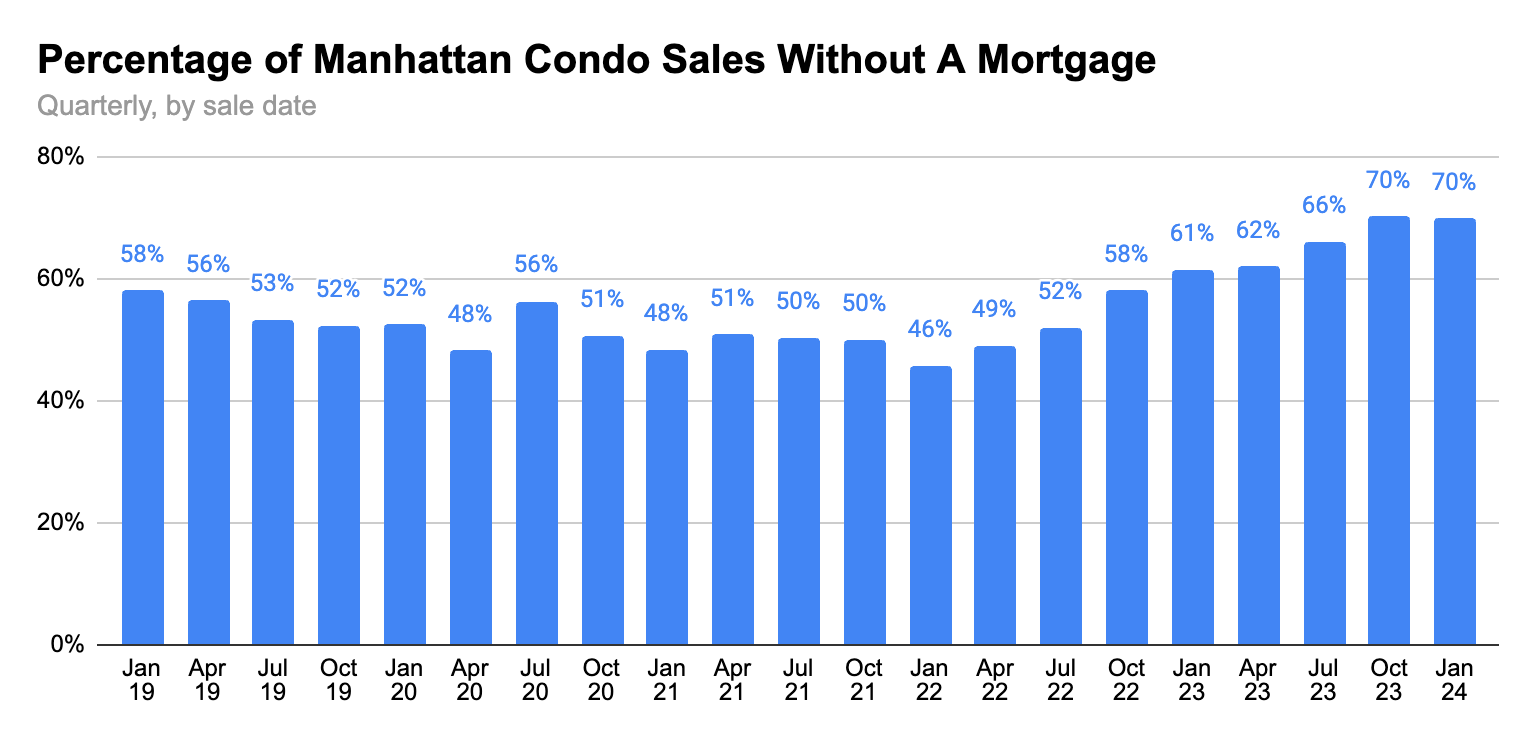

With high interest rates making financing expensive, NYC’s sales market has skewed towards buyers with more cash to play with. All-cash deals represented 63.4 percent of all transactions for Manhattan co-ops and condos in the first quarter of 2024, in the third-highest level of all-cash transactions on record.

Attracting a cash offer requires a good broker, a unit that’s priced right, and a subtle approach amid an overall slow market.

“A good broker is going to not just go for cash buyers, but make sure you get qualified buyers. That’s really the most important thing,” said Craig Roth, principal broker at real estate firm NextStopNY Real Estate.

If you’re looking to sell your apartment this year—and score an all-cash offer in the process—read on.

Work with a broker with experience and relationships

Your broker should be attracting as many potential purchasers as possible—those with or without financing, said Lisa Chajet, a broker at Coldwell Banker Warburg.

“It’s in everybody’s best interest to have everyone see a listing because you never know who wants it,” Chajet said.

It’s not only in your best interest; it’s required. Brokers cannot only advertise to a specific segment of buyers, and must share a listing broadly under rules set by the Real Estate Board of New York. But there are a few things your broker can do to specifically reach out to all-cash buyers, alongside their normal efforts.

A broker should tap their connections in wealth management firms, investment advisors, family offices, and with agents that represent cash buyers, said Fabiano Proa, an agent at Keller Williams.

Cash buyers may also be international buyers looking for a second (or third) home, parents looking to purchase a unit for their adult child, or an investor looking for a property they can rent out, Proa said. (That does mean that condos tend to be more attractive to cash buyers, because a co-op board may turn down someone who doesn’t intend to live at the unit full-time).

If you want to attract a cash buyer, it’s crucial to work with a broker who can leverage their relationships and experience to find you an offer, Roth said. So make sure to be specific about the type of offer you want, and to ask about their past experience, their relationships, and their past sales.

“A good broker should be a good networker,” Roth said. “They should be able to go to networking events with clientele who understand the financial market, and then also network with other financial advisors so they can tell their clients about good properties to buy in cash as well.”

Cash can mean a faster sale, but a lower price

A cash deal may be attractive to a seller because it provides more certainty and speed, Roth said.

All-cash buyers don’t need to wait for mortgage approval, and an all-cash deal can close around a month faster than a deal that involves financing, which could allow a seller to save on monthly carrying costs, Roth said.

You’ll want to look at each buyer's finances carefully. Apartment buyers usually need show they have three months in reserve funds to pay common charges or maintenance, depending on whether you're selling a condo or a co-op. (Co-op buildings also prefer buyers with a 22-24 percent debt-to-income ratio.)

Bear in mind that all-cash bids generally command a discount, which can run as high as 20 percent off, Proa said, and many cash buyers end up financing before the deal closes.

But a cash offer can also give a seller some leverage.

If you’re entertaining multiple bids, you may be in a position to favor a competing higher bid from a buyer using financing who waives a mortgage contingency, a clause that lets a buyer get their deposit back if they can’t secure financing and have to back out of the deal. But it’s worth noting that even non-contingent buyers may fight to get back their deposit if their financing doesn’t come through.

These days, it’s more likely that you’ll see a cash buyer because a hike in interest rates has made financing less affordable for buyers. As many as 70 percent of Manhattan condos were purchased with cash in January this year, according to the real estate data firm UrbanDigs.

Why it’s best to take a subtle approach

You don’t want your broker to solicit only all-cash offers, as that could indicate that your building has financial problems and could be a huge red flag for buyers, Chajet said.

“In terms of co-ops and condos, if you say all-cash only, it’s a red flag,” Chajet said. “It basically means the building doesn’t have enough shares sold, it could have financing problems—it’s not good. I would never advertise all-cash only. It’s just not going to get you anywhere.”

It’s best to solicit cash offers alongside a normal marketing process, Chajet said. If a seller is desperate to offload their unit, they can always drop the price, she added.