A condo or co-op with lower carrying costs can make buying more doable. Here's where to find one

- Buildings with tax abatements can lower your carrying costs for a number of years

- Pared-back amenities will generally result in lower carrying costs in the building

- Steep hikes in carrying costs are less likely in buildings with healthy reserve funds

Tax abatements, scaled-back amenities, and good financial management can help keep a building's carrying costs under control.

Emily Myers for Brick Underground

Buyers in New York City are increasingly looking at buildings with lower carrying costs as a way to exert some control over the market. Carrying costs are the monthly payments you make towards building operations: In condos these payments are called common charges, and in co-ops they are called maintenance.

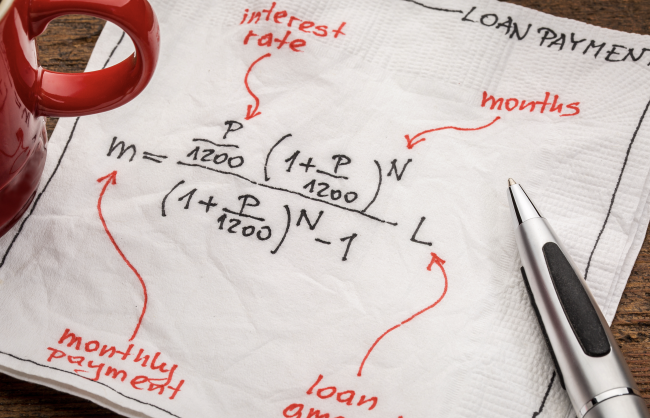

When these monthly payments are high, it can affect your debt-to-income ratio, which can, in turn, impact whether or not you meet the financial requirements of a co-op board or a lender. These payments can't be rolled into your mortgage and if you miss payments, you risk a lawsuit and in a co-op, eviction.

If you want lower carrying costs, brokers suggest you look for buildings with tax abatements—developers get incentives from the city to build in a particular area or incorporate more affordable housing in the building—and pass the savings on to the buyer. This will result in lower monthlies initially but it's important to remember these perks do eventually expire.

Another option is to revise your list of must-have amenities or scale them back completely. Also, make sure you understand the financials of a building before you commit to buying. Carrying costs will typically go up over the years but depending on how the building is run—whether it has a healthy reserve fund for example—those increases can vary in size. You want to avoid carrying costs that would overstretch your budget.

We asked brokers what advice they give to clients about carrying costs.

[Editor's note: An earlier version of this post was published in March 2023. We are presenting it again as part of our winter Best of Brick week.]

Buildings with tax abatements

There are fewer buildings with tax abatements than there were a decade ago. Many of these programs have wound down or expired but there are some buildings still offering this perk. You'll find tax abatements in buildings where developers have been offered incentives to build. For example, to encourage the development of downtown Brooklyn, Extell was offered a tax abatement to build Brooklyn Point, which is a condop on city-owned land.

Ari Goldstein, senior vice president of development at Extell, says buyers can use the monthly tax abatement savings to afford a bigger mortgage and gain greater purchasing power as a result.

In the past year Diana Zhang, an agent at Brown Harris Stevens, recently closed deals on four two-bedroom condos at Waterline Square, 30 Riverside Blvd., which has a 20-year tax abatement and lots of amenities.

“Buyers typically think the monthly costs will be expensive. However, the tax abatement changes the entire dynamic. For my buyers in particular, the affordable carrying costs make all the difference—they are able to get access to all of these incredible amenities and services while staying within their monthly budget,” she says.

A warning though: These tax abatements do expire. Typically they phase out over time. Mihal Gartenberg, a broker at Coldwell Banker Warburg, recommends buyers who are using an abatement to keep costs low have an exit strategy when taxes ramp up to their full amount.

"Substantial reserve funds [in the building] can give a buyer a sense of security against monthly assessments, but it’s never a guarantee. The best thing an agent can do for a buyer who is focused on their monthly costs is to find them a home that suits their needs under ordinary circumstances. Any additional discount is then a valuable perk and a surprise," she says.

Pared-back amenities

Norma-Jean Callahan, a broker at Douglas Elliman, says she typically likes to see monthlies under $3 per square foot, which would include amenities like a full-time doorman, an on-site super, maybe a gym, pool, or common outdoor space. Like Gartenberg, she advises buyers to take into consideration the full cost of monthlies when buying.

"Determine affordability with your lender assuming a normal, fully assessed tax rate, and then pursue a purchase when you understand what you can afford,” she says.

Board management and building size

A healthy reserve fund is important for the financial health of a building. Although there is no requirement to have these funds, the industry standard is to have three months of maintenance or common charges in reserve to deal with unexpected events like flooding, boiler repair, or roof damage.

As Gartenberg points out, strong financials give a measure of reassurance against sudden assessments but carrying costs do inevitably go up over time.

Kate Wollman-Mahan, an agent at Coldwell Banker Warburg, says she always advises co-op buyers specifically to review maintenance costs excluding the building’s taxes.

"Occasionally you'll find that one building has four times the tax bill of its neighbor. For example, a corner building on Fifth Avenue will likely pay significantly higher taxes than an adjacent building along the side street. If a building has lower taxes but similar maintenance, that tells you something about the efficiency of the board’s spending," she says.

You'll find this information in the financial reports for the building, Wollman-Mahan says.

"Often boards try to keep maintenance in line with buildings in the area, but there may be significant deviations in the services offered in each building, like the number of staff and taxes. Similarly, if a building has unusually low maintenance and hasn’t increased it in years, it’s likely that this building isn’t keeping up with capital costs for building maintenance. Maintenance must be reviewed within the context of building services, taxes, and capital investments all of which can be found in the building’s financial reports," she says.

Keep in mind, smaller buildings with fewer residents will typically have higher monthly costs because there are fewer residents to share the financial burden of capital improvements. What balances this out is that a smaller building will typically have fewer amenities.

Don't be duped by high tax deductions on maintenance

You may be aware that a percentage of your maintenance in a co-op is tax deductible. The amount varies by building and apartment and Vickey Baron, a broker at Compass, says a 70-plus percent tax deductibility would raise eyebrows for her.

"Think about your own personal taxes—if you are getting all the write-off it’s because you are spending a lot of money. If, say, you are getting 73 percent deductibility, that means the building probably has a large underlying mortgage with a high interest rate. If you see no underlying mortgage and strong financials you may see a lower tax deductibility, say 36 percent," she says.