How do high carrying costs lower the sales price of a co-op or condo? Is there a formula to figure this out?

- One approach: Use $2.50 per square foot as an average carrying cost, $5 for luxury

- Another way: Treat carrying costs as proportional to the size of the apartment

One option is to take the total of 10 years worth of higher-than-average monthlies to the negotiating table to help make your case for a discount.

marekuliasz/iStock/Getty Images Plus via Getty Images

In addition to the sales price of a co-op or condo, an important consideration when you buy in New York City is an apartment’s carrying costs—the monthly payments you’ll make towards building operations. In a co-op, these monthly payments are called maintenance, and in a condo, they are common charges. If you have a mortgage, you will have additional financial commitments. So when you consider apartments in buildings with higher carrying costs, very often your buying power goes down.

In his search for a Manhattan co-op to buy, New Yorker Harvey S. has been trying to figure out a way to number crunch this relationship. He reached out to Brick Underground to ask if there’s a formula to help quantify an apartment with higher carrying costs. Essentially he’s asking: If there’s an apartment with carrying costs of $3,000 a month and another, similar unit with monthly costs of $2,500 a month, is there a way to figure out how the difference in monthly payments should be reflected in the sales price?

To some degree, a formulaic approach ignores the huge variety in NYC apartments. For this reason, some brokers dismiss the idea of applying a formula, but others do have a numbers-based approach to figure out a relationship between carrying costs and sales price. It works best when you have narrowed down your search to two similar apartments, so you are left with just the monthlies and sales price as variables.

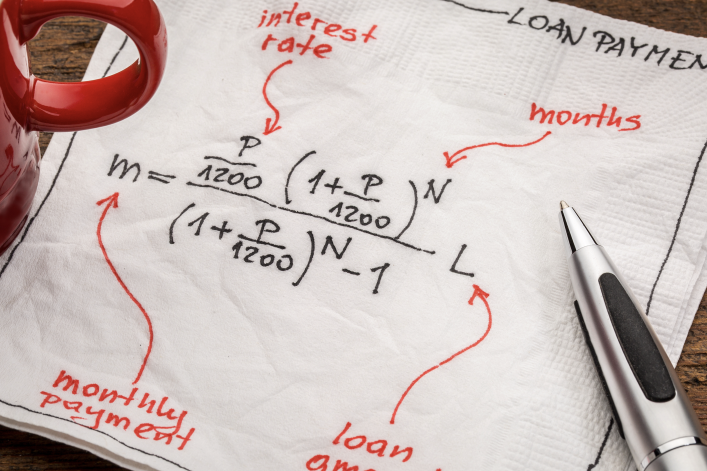

As for the calculations, there are a couple of ways to look at it—so get your calculator out—and read on for what NYC’s real estate experts have to say.

Don't be afraid of co-ops in NYC

"Co-ops are generally 10% less expensive than condos. Their rules are designed to protect the value of your apartment and ensure your neighbors are financially sound," says Matthew Steer of SteerKelly Team at Keller Williams. "As your broker, it's our job to make sure you qualify for the building you're interested in. We have a 99.9% success rate of getting buyers board-approved." Get in touch with us >>

Use average carrying costs as a benchmark

Seth Levin, a broker at Keller Williams NYC, says, in most cases he finds comparable apartments for a buyer and then discounts or adds to the sales price based on where monthly charges come in compared to similar types of buildings. Levin uses $2.50 per square foot as an average carrying cost for co-ops and condos. When individual buildings have units with higher-than-average monthly carrying costs, he discounts the sales price by $100,000 for every $500 that is above the monthly average.

Here’s how he guides his clients: “We add additional value if the maintenance is below that average using the same formula,” he says.

He points out this average calculation has limits. There are luxury condos with dozens of amenities where a monthly cost of $5 per square foot is the norm. In addition, if your preference is for a smaller building with a staff and amenities, it will typically have higher monthly fees than a larger, no-frills building.

"Some buildings have lower-than-average or above-average monthlies, based on location or service level," Levin says.

What would you get from investing the difference?

Jonathan Miller, president and CEO of appraisal firm Miller Samuel, looks at monthly carrying costs as proportional to the size of the apartment. He says when comparing two or more apartments, he makes sure, in his comparisons, that the various apartments are on a similar floor level; have similar square footage, usually within 10 percent; have a similar number of rooms and layout; and have similar building amenities. (It’s worth noting that this works for appraisal purposes but as a buyer, the apartments you are comparing might be very different and make apples to apples comparisons more complicated.)

For a formula, Miller takes the monthly carrying costs per square foot of the apartment he's appraising and applies that ratio to the costs per square foot of the comparative apartment.

“The resulting monthly of the comp and the subject-adjusted monthly of the comp are compared," he says. That can be done by using what he calls the "time value of money." Ask yourself, if you conservatively invested the difference during the average seven to 10 years you will own the apartment, how much would accumulate? You can do the same for all the comps after adjusting for amenities.

Miller says he’s always thought it interesting that many brokers assume that very high-end apartment owners don’t care about the size of the monthly carrying costs, when in fact, they do. Higher monthly carrying costs will bring down the sales price. “It matters,” he says.

The corporate finance approach

Similarly, Kobi Lahav, senior managing director at Living New York, says you need to take a corporate finance approach to the relationship between carrying costs and sales price. He suggests removing the tax component from the carrying costs in your calculations as these are set by the city and some of it is deductible up to $10,000.

When you're looking at apartments you'll get a sense of the average common charges or maintenance. On a $1 million condo, Lahav says, common charges (excluding tax) are around $1,000 per month, or $1 per square foot. If you then see an apartment, for example, with common charges of $1,700, consider that you'll be paying an additional $700 for the time you'll hold the apartment, on average, around 10 years.

An additional $700 over 120 months equals $84,000. If you were to keep that money in the bank for 10 years with an interest rate of 4 percent, the accumulated amount might be closer to $125,000. That's the discount you might ask for on the apartment with higher common charges.

"Common charges are going to go up, you are probably going to take a hit when you sell it, so there's got to be some accounting for it," Lahav says. This is what he calls "discounting it forward." If you bring these calculations to the negotiating table, you can make a strong case for the discount, he says.

A ratio for monthlies and loan value

Vickey Barron, a broker at Compass, says that every $100 increase in monthly payments could be equivalent to around $15,000 to $20,000 in loans. “Agents that don't understand that formula are missing an opportunity to enlighten a buyer or seller on the real perspective of what a value is,” Barron says.

As a theoretical example, a one bedroom listed for $1.2 million with high carrying costs (say $5,000 or more) might sell for $1.9 million if the carrying costs were low, in the region of $1,500.

Barron says it makes more sense to use a mortgage to cover the sales price than pay very high carrying costs unless the high carrying costs are reflected in a discounted sales price. Although she points out, the one thing that always goes up is maintenance and common charges. “Interest rates fluctuate but maintenance does not,” she says.

The psychological wild card in these calculations

Deanna Kory, a broker at Corcoran, says a mathematical approach can help you understand that a $900,000 apartment with $3,000 a month in carrying costs is equal to buying a $1.1 million apartment with $2,000 a month in maintenance or common charges. That’s because a 30-year mortgage for $100,000, with a 4.5 percent interest rate, means a monthly payment of approximately $500 a month. That extra $1,000 in monthly maintenance would support a $200,000 mortgage.

However, the number and level of amenities in a building can impact maintenance or common charges. Kory says it’s also important not to underestimate the “psychological aspect of having maintenance that is higher than it should be.” She says, in general, buyers prefer to pay mortgage payments over maintenance because you have control over those payments and no control over maintenance.

“In cases where the maintenance is consistently much higher than average, there will usually be an outsized negative impact on the final sales price that is usually disproportionate to the actual mathematical equation,” she says.

You Might Also Like