closing

… One of the closing costs you may need to pay on a condo or townhouse purchase in New York City is title … legal requirement but it may be a closing requirement if a buyer is taking out a mortgage for a unit in New York City although it wont apply to coops because of their unique shareholder structure In many …

… you can walk away from the deal and get your deposit back In a competitive market sellers typically … developments in exchange for providing a certain amount of affordable housing units The reductions in your tax … the building as well as your share of property taxes … Transfer taxes … The transfer tax is a sum paid on the sale …

… Determining how much you can afford to spend on a condo coop or townhouse in NYC isnt as easy as … boards dont want to see housing costs exceed one third of a buyers gross income says Anthony Morris who leads a team of …

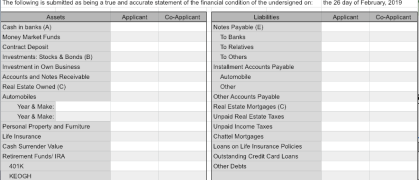

… The REBNY Financial Statement is a form that shows a buyers finances to the sellers listing agent Its what starts … the right balance of income and debt to be presented to a coop board The spreadsheet is fairly straightforward but … to your agent if you are buying a coop If youre buying a condo preapproval from a bank is usually enough making the …

… sponsor apartment pick of the week where we feature a coop for sale by the owner of the building You do not need board approval to buy these apartments they are often newly renovated and they … 20 to 25 percent that most coops demand In exchange for the condolike ease of acquisition expect to pay a bit more than …

… against a building or apartment you are interested in buying isnt ideal but its not a deal breaker either A lien … obligated to spend Thats usually negotiable And then as a buyer youd want to negotiate getting rid of some … … Buy … buying … closing … Co-ops … condos … taxes … townhouse … The property you are buying has …