What's a financial disclosure statement?

The document shows a buyers' debt to income ratio and helps with negotiating the purchase.

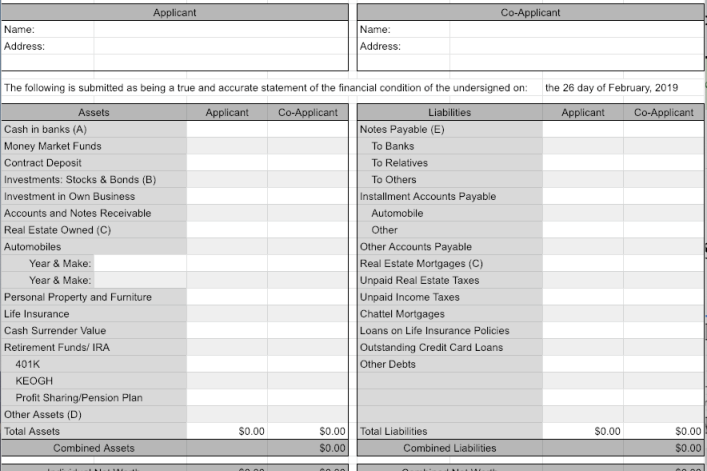

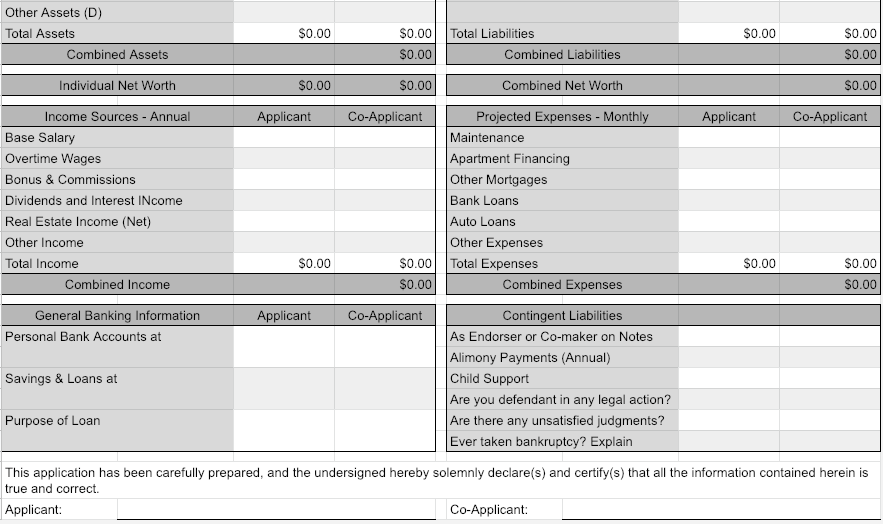

The REBNY Financial Statement is a form that shows a buyer’s finances to the seller’s listing agent. It’s what starts the negotiation process for the purchase, by allowing the seller’s agent to see whether the buyer has the right balance of income and debt to be presented to a co-op board.

The spreadsheet is fairly straightforward but needs to be accurate and up-to-date. Prevu, a real estate tech firm and Brick Underground sponsor, has created a downloadable template to make it simpler for buyers to fill out. The details are given to your agent if you are buying a co-op. If you’re buying a condo, pre-approval from a bank is usually enough, making the form unnecessary.

Teresa Stephenson, vice president of NYC brokerage firm Platinum Properties, says the information helps in identifying the right co-op for your budget.

“The deb-to-income ratio is one of the most important factors, as well as the amount of liquidity you have and how much you will have after the purchase. [The seller’s agent] wants to see that you have two years of monthlies after the purchase,” says Stephenson.

She says she lets her clients know the form is something they will have to turn in.

“[An agent] needs to know which co-op to bring you to. Most co-ops allow a 20- to 25-percent debt-to-income ratio. There are some that will consider 30 percent. You might discuss with your agent how to bring down the debt-to-income ratio,” she says.

There are separate sections for income and debt, liquid accounts and retirement accounts and sections to fill out if you own additional properties. Rather than leave spaces blank if they are not relevant, Stephenson encourages clients to write ‘n/a’ or ‘not applicable’ to avoid confusion. In fact, she says she often get clients to fill it in by hand and then completes the spreadsheet for them.

“If the information isn’t accurate you are just wasting everyone’s time,” says Stephenson. She adds, “A co-op board application needs to be exact to the penny, the financial disclosure statement can be slightly rounded, but certainly if you’ve withdrawn 10 percent of your savings you should update the document.”

You Might Also Like