- An assessment is a temporary increase in carrying costs to pay for building upgrades

- It is calculated based on your condo common interest or your shareholding in a co-op

Assessments allow a building to avoid a permanent increase to carrying costs.

Travel Wild/iStock/Getty Images Plus

Co-op and condo buildings often need to fund capital projects like repairs to the elevator, roof, or façade. To pay for these upgrades, boards often use assessments. These are temporary increases added to your maintenance or common charges to cover a specific improvement or top up a co-op’s reserve fund.

Assessments can run for a few months to a few years, depending on the cost of the upgrades. Whether a board imposes an assessment or not can depend on how much money they have in the building’s reserve fund—that is, how much cash they have on hand for emergencies.

Imposing an assessment allows a board to avoid a permanent increase to the condo’s common charges—or a co-op's maintenance—sometimes referred to as dues or fees. Both higher-than-average carrying costs and large assessments can impact the sales price of an apartment.

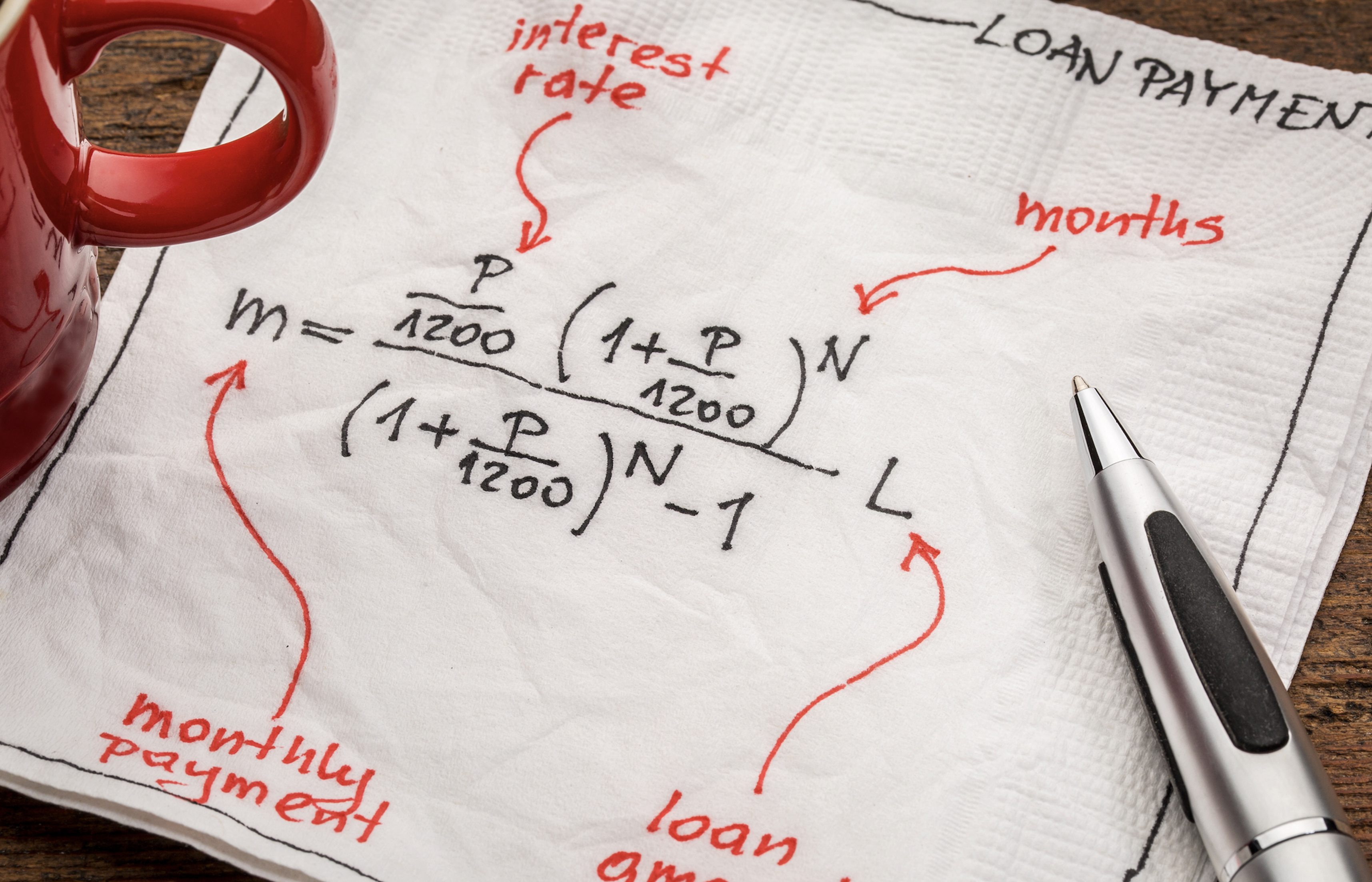

How are assessments calculated?

Assessments are calculated based on the common interest that each apartment is assigned in a condo building or the shareholding in a co-op.

Kobi Lahav, senior managing director at Living New York says, even if the square footage is identical, assessments can vary between apartments. “A higher floor will usually have a higher common interest ownership of the condo as it is using the elevator more than a ground floor unit,” he says.

Sometimes the assessment will also include loan interest if the project is being financed with the help of a bank. “That will also be broken down by shareholding in a co-op or or percentage of common interest in a condo,” says Lucy Wu, an agent at BOND New York.

Are assessments bad?

Assessments are a sign the board is putting money back into building, which benefits owners. “Every building will have some sort of an assessment in the lifetime of their ownership,” Wu says.

Ideally your building will have both a capital plan and a healthy reserve fund. The capital plan is an evaluation of your building’s assets prepared with the help of an architect or engineer and the input of the management company and super. It will identify the age of the elevator, boiler, sprinkler system, façade, and roof, when it might need repairs or a replacement and at what cost.

Once the capital plan is established, the building needs the reserves to pay for it. This can come through increases in common charges, the introduction of a flip tax, selling a building’s air rights, or refinancing a co-op’s underlying mortgage.

Wu says condos don't tend to hold huge reserves, so an assessment is fairly standard. Three months of operating costs is the norm for buildings but there is no requirement, although it might be more difficult to get a loan to buy in a building with low reserves. “Even if a condo has high reserves, the association may vote not to touch the reserve and still implement an assessment,” she says.

If a building is relying too heavily on assessments to pay for upgrades, it could be a sign there are limited reserves, which could be a problem if there’s an emergency. (Which is why it’s always good to get this information from the financial statement of a building before you buy).

Do assessments affect sales price?

Assessments will vary based on how many apartments are in the building. “The more apartments, the lower the hit on each unit,” Lahav says.

For example, the cost of a project for owners in a building with 20 apartments is higher because it is divided by a smaller number of people. “In a larger building of 300 units you can expect that even if the total cost is higher, the actual cost for each unit will probably be smaller,” Lahav says.

Lahav usually insists a seller pays for any ongoing assessment at the closing. “If there is a future assessment, we try to negotiate that it will be taken into consideration when pricing the unit,” he says.

Higher carrying costs can negatively affect the sales price of an apartment. To understand this, consider $2.50 per square foot as the average carrying cost for co-ops and condos. This is the metric used by Seth Levin, a broker at Keller Williams NYC, who says when buildings have units with higher-than-average monthly carrying costs, he discounts the sales price by $100,000 for every $500 above the monthly average.

"As long as assessments go away, they mitigate this issue," Levin says.

Can energy efficiency upgrades be funded by assessments?

Energy upgrades are increasingly front of mind for boards as buildings are asked to move away from fossil fuels and comply with emission requirements under Local Law 97. Using assessments to fund big capital projects might be an option, but can be problematic—assessments put pressure on co-op and condo owners and there’s also the impact on sales price to consider.

Lahav says he increasingly bases pricing decisions on the age of the building. New construction is built with emissions standards in mind so potential assessments for that are less likely. Older prewar buildings or those built in the 1960s will typically need substantial upgrades in the next 10 years to meet the new energy standards, he says.

If you’re buying for the first time, Wu suggests finding an apartment with low common charges or maintenance to help lessen the financial burden if an assessment takes place.

Wondering if a building has a low energy rating, or other issues? Run the address through the Brick Report and get a real estate background check built from all of New York City's Open Data in one place. Brought to you by Brick Underground.

You Might Also Like

Sign Up for our Boards & Buildings Newsletter (Coming Soon!)

Thank you for your interest in our newsletter. You have been successfully added to our mailing list and will receive it when it becomes available.