Redlining: How one racist, Depression-era policy still shapes New York real estate

If you've recently walked down a block of Park Slope, you likely came away with this image: leafy trees, clean streets, pristine townhouses. It's one of the most desired neighborhoods in Brooklyn, and one of the priciest.

Which makes this picture seem all the more unlikely: peeling paint, broken windows and missing stoops on townhouses, some of which were abandoned and burnt-out, not to mention the rat-infested buildings on Prospect Park West that were known as a breeding ground for "prostitution, crime, vice, narcotics and immorality," according to the New York Times.

This was Park Slope of the 1960s and 1970s, often known as the "bad old days" of New York. How'd the city get to a place where many other neighborhoods looked like Park Slope?

(This story originally was published on November 5, 2015.)

One of the main reasons, known as redlining—the racist housing laws of the mid-20th century—has garnered more attention as of late, sparking conversations of how this exclusionary housing policy still affects cities today.

In 2014, writer Ta-Nehisi Coates dissected the housing policy in his essay for the Atlantic, "The Case for Reparations." In it, Coates writes that redlining "herded" African Americans "into the sights of unscrupulous lenders who took them for money and for sport," while "whites looking to achieve the American dream could rely on a legitimate credit system backed by the government."

The website Urban Oasis digitized a collection of redlined maps for the public, and the issue has also recently been tackled in podcasts. Just last week, the Times published an article that found biased lending practices alive and well throughout the East Coast. (One New Jersey bank was found engaging in discriminatory practices that, though not quite as obvious as redlining of yore, still created a system akin to it.)

Still, many New Yorkers only have a vague idea of what redlining actually was, and how it continues to affect New York, particularly in some of our most buzzed-about neighborhoods like Williamsburg and Chelsea.

The history

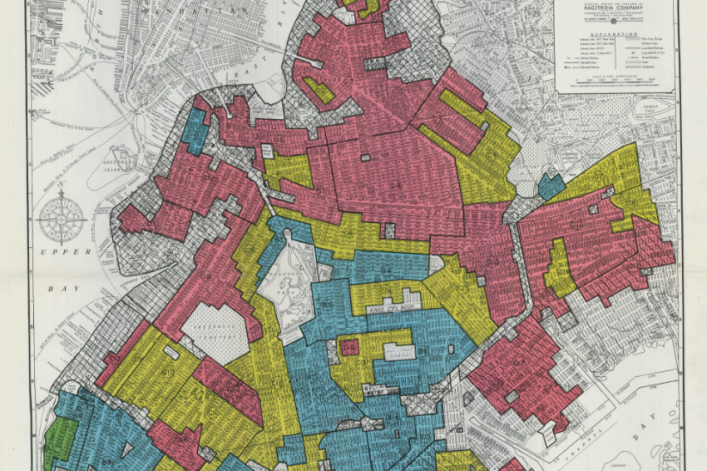

Redlining began in the 1930s when the Federal Housing Administration (FHA) was created to insure mortgages. If a neighborhood was deemed too chancy, banks didn't lend there. The FHA relied on maps drawn by the Home Owners’ Loan Corporation (HOLC), a governmental body. Writes Coates: "On the maps, green areas, rated “A,” indicated “in demand” neighborhoods that, as one appraiser put it, lacked “a single foreigner or Negro.”

These neighborhoods were considered excellent prospects for insurance. Neighborhoods where black people lived were rated “D” and were usually considered ineligible for FHA backing. They were colored in red." The red swaths of neighborhood led to the term redlining, which was coined in the 1960s.

Although redlining is no longer enforced by the government, many of those neighborhoods still have some of the highest New York poverty rates, despite the fact that the New York we now live in is one often associated with wealth and luxury condo development.

And in an ironic twist, many of the other neighborhoods the HOLC once deemed high risk because of “undesirable inhabitant types” are now rapidly gentrifying, with soaring real estate prices. The result? A city with one of the largest gaps between the rich and poor in the country, according to a 2014 article by the Times.

Manhattan's original HOLC map—click to expand in a new window. (Via Urban Oasis.)

A tale of two lending tiers

To fully and most easily understand the effects of redlining, you have to look at the maps. In 1935, the HOLC released color-coded maps of 239 cities after gathering a variety of data: neighborhood terrain, ages and types of buildings, sales and rental demand, and the “threat of infiltration of foreign-born, negro, or lower grade population,” as the HOLC put it.

This data was then mapped, designating the so-called desirable neighborhoods (read: white neighborhoods) from “high risk neighborhoods” with primarily African American residents. In all five boroughs, green/"desirable" neighborhoods were few and far between: Inwood, the Upper East Side, Brooklyn Heights, Riverdale, and only a few blocks of Forest Hills, Queens.

Blue areas were considered "still good" but not as desirable—neighborhood like the Upper West Side or Bay Ridge. Yellow areas, which typically bordered red neighborhoods, were in "transition" and considered to be in decline.

With coding in place, lenders were discouraged from making real estate investments in redlined areas, resulting in residents (or prospective buyers) in minority neighborhoods ineligible to receive financing for home purchases, per this article from Liberation School.

At the same time, housing policies ensured that buyers in “green” neighborhoods were receiving federally-insured home mortgages that guaranteed certain buyer-friendly terms, including smaller down payments and 30-year payment plans.

If you were white and middle class, the government essentially offered sizeable subsidies to make it easier to buy a home. Because there were so few "green" areas in New York City, the policy prompted a migration of white New Yorkers to the suburbs, deemed safer places for home investments.

If you were African American, simply getting a mortgage in your NYC neighborhood was pretty much out of the question. As Coates states of redlined neighborhoods, "Neither the percentage of black people living there nor their social class mattered. Black people were viewed as a contagion."

As a result, many owners in these areas stopped investing in their properties and neighborhoods fell into decline. This affected huge swaths of New York: in Brooklyn, most of North Brooklyn, as well as Cobble Hill, Gowanus, Sunset Park, Dumbo, Fort Greene, Bed Stuy, East New York and Coney Island were redlined.

In Manhattan, it was parts of Chinatown and the Lower East Side, Chelsea, the lower west side, and much of the far east side up through 96th Street. All of Harlem was coded red, as well as a huge swath of south and central Bronx.

In Queens, it was parts of Astoria and Long Island City, Corona, Jamaica, and the neighborhoods surrounding JFK Airport. Although the HOLC ceased operations in 1951, the Fair Housing Act—a law finally prohibiting discrimination concerning the sale, rental and financing of housing based on race, religion, national origin and sex—was not established until 1968.

By then, the damage of exclusionary housing policies in cities was severe. “It was felt the most in the 60s and 70s,” said Ilene Popkin, a fellow at the Citizens Planning Housing Council, a New York nonprofit housing organization founded in 1937. “There was a white middle class flight and people couldn’t get loans for many neighborhoods in the city, so many landlords just walked away from their buildings.”

Tom Mellins, the curator of the Museum of the City of New York’s current exhibit, Affordable New York: A Housing Legacy, also pointed out that direct federal support for publicly subsidized housing in New York all but disappeared after 1973, even further diminishing the quality of housing. “New Yorkers have forgotten, or younger New Yorkers don’t know, the major disinvestment in the city at that time.” Although it may seem like a thing of the past, it remains a major cause of income and housing inequality in the city today.

The south Bronx didn't fare too well on the HOLC maps, while more suburban neighborhoods like Riverdale were given the go-ahead for investment—click to expand. (Via Urban Oasis.)

And the hits keep on coming

So what happens when the federal government loses interest in the city, banks are hesitant to finance mortgages throughout the five boroughs, and property owners are walking away from their buildings, or in cases like the South Bronx, burning them down? The city reached a fiscal crisis by the mid-1970s, when it barely avoided defaulting on its obligations and declaring bankruptcy, and New York seemed to be in irreversible decline.

Despite all that, grassroots efforts and initiatives by the city worked to pull the city out of crisis. “It’s a long line of housing policy from the disinvestment of New York to the reinvestment of communities,” said Popkin.

Popkin pointed to the Department of Housing Preservation and Development, formed in 1979 to manage all the city’s foreclosed housing, as one reason the city started to recover. Through the next 20 years, the HPD teamed with nonprofit and private developers to reinvest in the housing stock and preserve affordability.

The idea, as stated by Ed Koch, the New York mayor who undertook an ambitious affordable housing initiative in 1985, was such: “We’re creating more than just apartments – we’re re-creating neighborhoods. We’re revitalizing parts of the city that over the past two decades have been decimated by disinvestment, abandonment, and arson.” In the late 70s, the city also started the H.D.F.C., or Housing Development Fund Corporation, to convert derelict apartments into low income co-ops.

Investments like this, not to mention laws that barred discriminatory housing practices alongside grassroots neighborhood activism, helped lead us to the New York we live in today: one that seemingly everyone wants to live in. Although all these factors helped dismantle redlining over time, the policy still created a unique background in which rapid gentrification is now taking place.

In neighborhoods where it was impossible to secure a mortgage not too long ago, homes and apartments sell for millions. And while gentrification can lead to commercial development and safer streets—a stark contrast to the New York of the 70s—it often means wealthier tenants are displacing poorer, longer-term residents. (In some cases, there is still race-based motivation behind displacement, as outlined in a startling New York Magazine article earlier this year.)

The result is often that longtime New Yorkers who did not have the same opportunities for homeownership, not to mention the security and wealth accrual that comes with it, are being displaced from their neighborhoods now that the areas have been deemed desirable.

“For long-term residents in disinvested neighborhoods, they were initially fighting to keep housing liveable and fighting against abandonment,” said Sam Beck, a Cornell professor who studies gentrification in North Brooklyn. “Now they’re struggling to keep their community in the neighborhood.”

Beck is critical of the argument that gentrification brings much-needed amenities to neighborhoods, like supermarkets—"Why is it that Williamsburg had to wait for yuppies and hipsters to move there before it got these amenities?” he asks—but at the same time, safer, cleaner neighborhoods are still highly preferable to the New York of the 70s.

“Back then, neighborhoods were not good for anyone,” said Popkin.

Another ironic and unintended result: Gentrification is creating diverse, mixed-income neighborhoods (at least for now) in formerly redlined areas, and that diversity has become part of their very appeal to well-off new residents, even as their presence threatens the prospect of its long-term sustainability. “Wherever gentrification is taking place in New York tends to be the most mixed communities in the city,” said Beck.

He added, “New Yorkers now have a romantic idea about this mixed-income blend, they value a mix.” That’s also reflected in Mayor de Blasio’s current affordable housing policy, which prioritizes mixed-income developments with vibrant commercial and park components.

So is it possible to strike a balance between the strong communities that have lived in these neighborhoods and the changes coming in?

Beck thinks the key is electing local politicians who believe in affordable housing and can be hard on developers, as well as showing up to community board meetings and supporting community-based organizations. Because like most New Yorkers, he doesn’t think gentrification is going anywhere soon.

“Wherever the subway leads, that’s where gentrification will occur,” he said. A far cry, indeed, from the days of redlining: “NYC real estate has become the best place to put your money now,” he adds.

You Might Also Like