'The Battle of Rent Regulation': Attorney puts NYC tenants' struggles to music

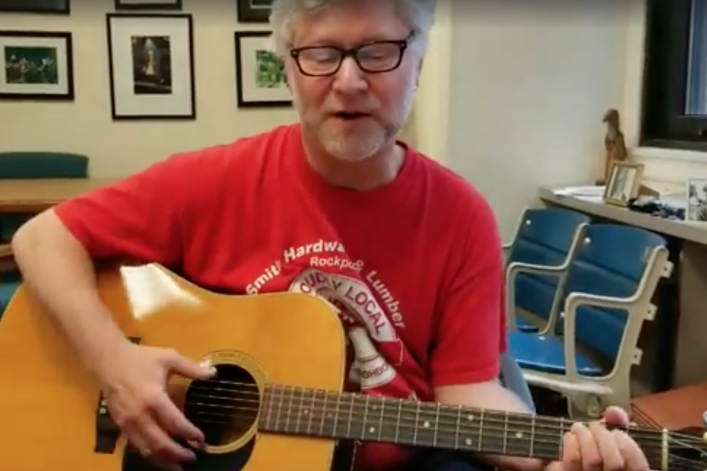

Attorney David Hershey-Webb has penned a catchy tune about rent regulation in New York City.

The city's labyrinthine rent stabilization code is complicated enough to set tenants' heads spinning. Enter one tenant attorney-songwriter who is hoping to clarify matters with the power of song.

David Hershey-Webb, a lawyer with Himmelstein, McConnell, Gribben, Donoghue & Joseph LLP (a Brick sponsor, FYI) recently wrote a catchy ditty that outlines some of the landmark decisions that have shaped rent regulation, specifically for buildings receiving J-51 tax abatements, which offer landlords tax breaks to do renovations on distressed buildings in return for giving tenants in the building stabilized leases.

Here's Hershey-Webb performing the short song, which is jam-packed with case law and major players from the hurly-burly world of New York City real estate.

Got all that? Assuming, not, don't worry, because we talked to the tenant-side troubadour for some help annotating the lyrics:

ROBERTS SONG

by David Hershey-Webb

The Court of Appeals turned the world upside down

When it issued Roberts for Stuyvesant Town

The tenants were up and the landlords were down

But the battle had only begun…

In 2009, an appeals court decided the Roberts vs. Tishman Speyer case, ruling that StuyTown tenants had been illegally deregulated while the landlord was getting J-51 tax benefits.

It’s the battle of rent regulation

The tenants say yes, the landlords say no

It’s the battle of rent regulation

It’s wherever you are, wherever you go

Base date rent

Four-year rule

Himmelstein challenges

Belkin to a duel

The four-year rule, Hershey-Webb explains, says that there is a four year statute of limitations on collection of rent overcharges. In most cases, the court or state rent agency cannot investigate rent overcharge complaints dating to more than four years prior to when the complaint is filed. However, in J-51 cases you can look back more than four years.

"That's a big battle for tenants," Hershey-Webb says of the rule.

Belkin is Sherwin Belkin of Belkin, Burden, Wenig & Goldman, LLP, an attorney who has represented landlords in J-51 cases.

Lucas, Schiffren

Taylor and Park

Trebles got a bite

‘Cept when they only bark

The 72A Realty vs Lucas court decision said that a tenant's apartment in a building receiving J-51 tax breaks was illegally deregulated. The apartment was re-stabilized as a result, and the court ruled that it could review a rent history beyond the four-year period to set the correct rent, in part because the landlord had not established the validity of the rent increases used to deregulate the apartment. The court also ruled that the tenant could receive treble damages and attorney’s fees.

In the Schiffren vs. Lawlor decision, the Court of Appeals ruled that once a J-51 tax abatement has expired, landlords can practice high-income deregulation (that is, deregulate the unit of a tenant earning more than $200,000 a year for two years and paying $2,700 or more in rent a month) if the tenant lived in the apartment before the J-51 was put in place.

The recent Taylor vs. 72A Realty decision found that when an apartment has been illegally deregulated while the landlord received J-51 benefits, the base date market rent should not be accepted, even if the landlord has proof of renovation costs that were used to deregulate that apartment. Therefore, the rent history going back more than four years should be reviewed to determine the correct rent.

In Park vs. the New York State DHCR, an appellate court upheld the four-year rule, finding that a previously rent-controlled apartment had become market rate.

Trebles refers to treble damages, that is, when a landlord has to pay a tenant three times the amount the tenant was overcharged on rent. This is applied when the overcharge is deemed "willful." You can get treble damages starting two years prior to when your complaint was filed.

Where’s the registrations

Blame the DHCR

So much litigation

Time to file a PAR

The DHCR is the Division of Housing and Community Renewal. A PAR is a petition for administrative review, an appeal of a DHCR decision.

J-51

3212

And the battle goes on

We can’t help ourselves

3212 is a rule that allows lawyers to seek a summary judgment—that is, a court judgment that can be issued without a full trial based on the law when there are not material facts in dispute.

It’s the battle of rent regulation….

The Court of Appeals

Turned the world upside down.

This part, mercifully, is fairly self-explanatory, knowing what we know by now.

You Might Also Like