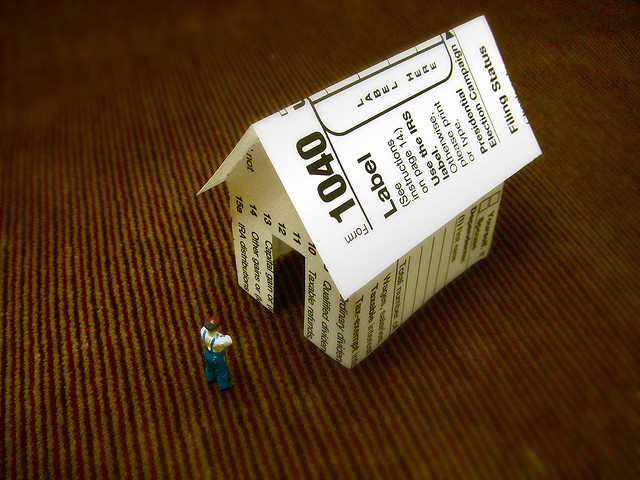

What is a property tax abatement on a New York City condo, and why does it matter?

Put simply, a tax abatement is exactly what it sounds like: a break on a building or apartment's property taxes. Of course, in practice, it's a little more complicated than that.

For one, there are many different types of abatements given to buildings for different reasons. Perhaps the most well-known is the 421a abatement, which recently expired, but gave developers (and therefore individual owners in buildings, as well) a big break on taxes in exchange for including a certain amount of affordable housing in their projects. (Most notably, 421a was responsible for so-called "80/20" buildings, which include 20 percent affordable rentals.) This is the reason why you'll see so many headlines on the seemingly dry subject of abatements; while not the most scintillating of real estate topics, tax abatement programs have a significant impact on what and where developers can afford to build in New York City, which in turn has a big effect on neighborhood housing markets.

"I do think it is crucial to have this incentive, and [without 421a], you're going to see a slowdown of new housing," says real estate attorney Martin J. Heistein. "And with a city like New York where people are constantly coming in, we can’t even keep up with the available housing stock as it is." In other words, there's concern that even though most new development is high-end, creating any kind of new housing is better than creating none at all when it comes to helping the city's housing crisis, and that tax abatements help to make this happen. (For an extreme example of what happens when you don't build, take a look at the state of San Francisco's housing market—prices are sky-high thanks to a severe disparity between supply and demand, a problem many feel is exacerbated by the city's stringent rules about putting up new buildings.)

But how do tax abatements actually affect the typical New York City buyer or renter?

For renters, 421a doesn't have much impact, unless you're lucky enough to snag one of the subsidized rentals in an 80/20 building. The more important one to know as a renter is the J-51 tax abatement, which landlords receive for major renovations to a building. It won't make your rent lower, but there's one crucial rule that will make a big difference for you: As long as your landlord is receiving a J-51 tax abatement, your apartment should fall under rent-stabilization. (More details on that here.)

If you're buying into a building with an abatement, that can mean you save serious cash on your monthly costs.

"For instance, I own at the Edge in Williamsburg, which has a 25-year tax abatement," explains Andrew Barrocas, CEO of MNS Real Estate. "My taxes there are $40/month, and if there weren't an abatement, they would be $500/month." Generally, a tax abatement will last for a set amount of time (for example, 15 years or 30 years ), with taxes slowly ramping up by a certain percentage point over time.

The appeal of lower taxes can raise the asking price of an apartment with an abatement; on the flip side, as the abatement draws to a close, a seller might have to lower their asking price to incentive buyers who know their monthlies are going to increase.

"Obviously, it's important for a potential purchaser to check to see when a building's abatement began, and how long it's going to last, so they know how long it will benefit them," notes Heistein. This can all be done during your attorney's due diligence research on the building.

Another type of abatement to keep in mind: Co-op and condo owners who use their apartment as their primary residence, don't have more than a certain number of properties, and aren't already receiving some other kind of abatement can apply for the Cooperative and Condominium Tax Abatement (more details here), with a potential reduction in property taxes that will vary depending on the assessed value of the apartment.

You Might Also Like