For many millennials, homeownership remains out of reach

Millennials—the generation born between 1980 and about 2000—have progressed further in higher education than any other generation before them: According to the White House's report on millennials, 47 percent of this cohort has received a postsecondary degree, an amount unprecedented in American history. But while there's generally a correlation between educational attainment and income level, Americans under 35 have been notably slow to purchase homes. It's a lag that's particularly striking in NYC, where young renters outnumber young homeowners four to one, while in cities like Philadelphia and Chicago, those numbers are closer to even.

CityLab reports that these days, going to college can act as both a path to homeownership and an obstacle to it. Data from a recent Pew Research Center study reveals that the difference in median monthly income between millennials with bachelor's degrees and those without has widened significantly over the past 25 years. While those who graduated from college saw a 13 percent rise in earnings between 1984 and 2009, the take home pay of young people with high school diplomas actually dropped during that same time.

The declining wages explain why non-degree holding Millennials have trouble purchasing homes, but their peers with bachelor's and advanced degrees aren't exactly buying in droves, either. (CNBC reported last year that the homeownership rate had dropped to 63.4 percent, the lowest in decades.) CityLab quotes economist Mark Fleming, who posits that extra time spent in college is why millennials are slow to enter the market.

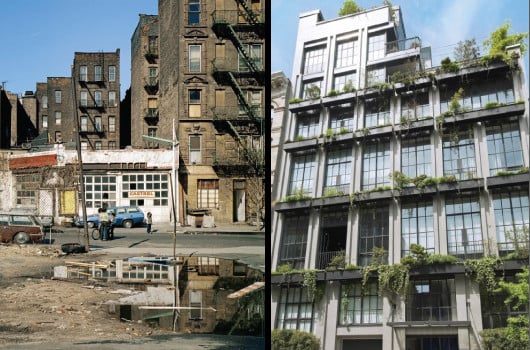

A recent article in the Los Angeles Times suggests a few more possibilities: Lately, real estate developers are targeting older and wealthier populations, leading to a diminishing stock of homes accessible to first-time buyers. Nicole Beauchamp, an agent with Engel & Völkers, notes that another generation—the Baby Boomers—are a growing demographic for new developments in cities, as many of them retire, sell their houses in the suburbs, and relocate to livelier areas. "It's hard for Millennials to navigate when there are buyers who have sold homes and have equity returning to the city," she says.

Furthermore, millennials are delaying other traditional milestones—the White House report found that only 30 percent of people age 20 to 34 are married, for instance—and the prospect of investing in a home may hold less appeal for young singles.

Education may further inhibit millennials since the debt they carry from college leaves them short on funds for buying property. The White House report notes that average student debt reached $30,000 in 2012, graduates are taking longer to make payments, and more borrowers are defaulting on their loans. "For someone who just graduated and has six figures of debt, affordability is a huge issue," Beauchamp says. "Their burden is unreal."

Joseph Leffe, a mortgage loan officer with TD Bank in NYC, says he's noticed a distinct lack of millennial homebuyers among his clients, and those he does encounter often need a bit of a reality check.

"I've come across very few millennials buying a home on their own," Leffe says. "I usually spend time with those people breaking down reality for them. I consider it my pro bono work. Sometimes when they see how out of reach the situation is, they just give up and keep renting."

Sofia Song, executive vice president of research at Douglas Elliman, says that the financial crisis has inflicted damage to millennials in two ways: On the one hand, many of them graduated into an economic recession, and on the other, banks reacted by requiring larger down payments for homes.

"Mortgages are not going to come easily to millennials," Song says. "Before the crisis, people were putting down 5 or 10 percent, and then they could take out a loan for 90 percent. But now credit is still tight, and banks are requiring a minimum of 20 to 25 percent down."

And in cities like New York, where rents are so expensive, Song says, "it's going to take a lot longer for millennials to put together that large of a down payment."

Many of the young people who do buy are doing so with help from family members, Leffe says. The White House report reveals that in addition to receiving financial support from family, a significant percentage of millennials—31 percent—are still bunking with their parents rather than setting out on their own.

This makes sense, says Song: "Most millennials were faced with the worst financial crisis in global history. When you have that much uncertainty in your immediate future, you go back to a place of security, which for many is with their parents."

Leffe suggests that millennials who are considering taking the plunge and buying a home do their research first: "You can have a meaningful understanding of what it takes to accomplish your goal, and you can set that goal for sometime in the future," he says. "And you just have to pray that the anomaly that is New York real estate doesn't exponentially outgrow that future goal."

Indeed, in NYC, homeownership seems particularly out of reach for all but the wealthiest of millennials, given that the average price of a Manhattan apartment just exceeded $2 million, per The Real Deal. Young people can take heart, perhaps, in remembering that even if they haven't put down roots, they're in good company--most of their peers haven't, either.

**This story originally ran on May 17, 2016.**

You Might Also Like