A lawsuit aims to address NYC's confusing approach to assessing property taxes

S. Jhoanna Robledo

New York City's system of assessing property taxes for homeowners within the five boroughs is inequitable, a new lawsuit alleges, placing a disproportionate burden on homeowners and renters in some neighborhoods while undercharging New Yorkers in wealthier areas.

The lawsuit, the New York Post reports, was filed by a group called Tax Equity Now New York (TENNY) on the grounds that the city's property tax code violates equal protection and due process under the state and federal constitutions, as well as fair housing laws.

The issue seems to have made for strange bedfellows: TENNY's website reveals that the coalition of groups behind the action include both tenant advocates and major developers. The group notes that lower-income renters and owners in NYC are paying a higher effective tax rate than their affluent counterparts, a claim that Greg David, a columnist and economics reporter, backs up in Crain's. Mayor Bill De Blasio, David points out, pays less in property taxes on the two rowhouses he owns in Park Slope than a retired saleman in Laurelton, Queens pays on his $396,000 home.

New Yorkers have long known that while living in NYC means contending with all kinds of mind-boggling expenses (like, say, parking spaces selling for $200,000), one area in which they get a break is on their property taxes, which tend to be much lower than those of their suburban counterparts. Per Smart Asset, the city property tax rate is 0.72 percent, compared to a statewide rate of 1.5 percent; in neighboring Nassau County, on the other hand, it's closer to 2.2 percent.

But, data blog Metrocosm explains, that low overall rate doesn't reflect the whole story. Because the city's housing stock is so varied, it's difficult to create an efficient system for calculating each property's tax, so the city's Department of Finance assesses co-ops and condos based on the value of nearby "rental properties similar in physical features and location to the condominiums or cooperatives." As Metrocosm writer Max Galka explains, this method comes from the good old days of NYC, when condos, coops, and rental buildings were all far more alike in value.

The development booms of recent years have yielded a glut of high-rise, luxury sale condos that have a much higher value than that of their neighboring rental buildings, but they are still assessed based on what those properties are worth. This all means that a small homeowner in Queens could be paying a higher property tax rate on his or her home than one who just bought a brand-new condo in downtown Manhattan.

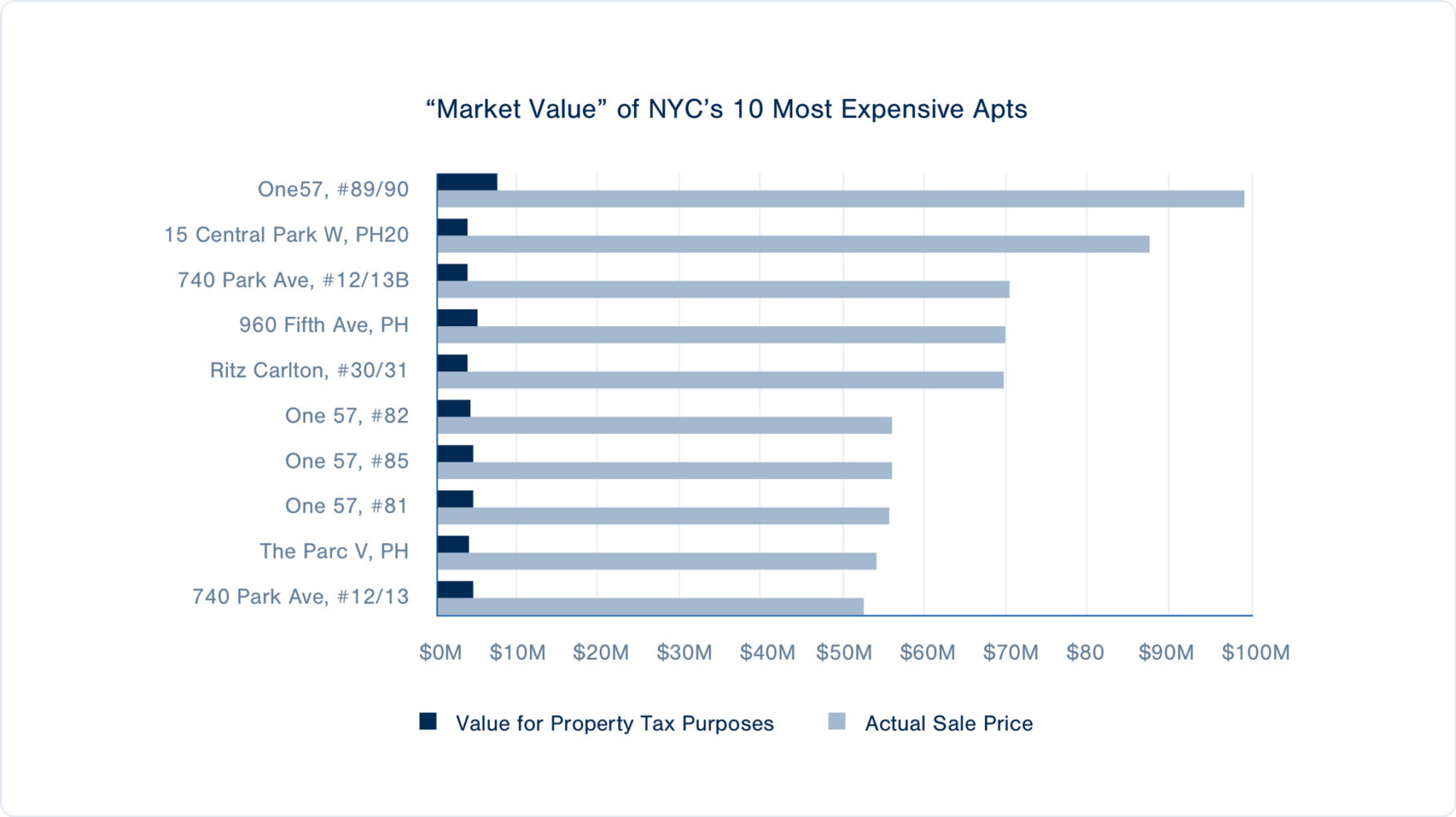

The TENNY graphic below reflects the disparity between actual value of high-end properties in Manhattan, and how they're valued for property taxes.

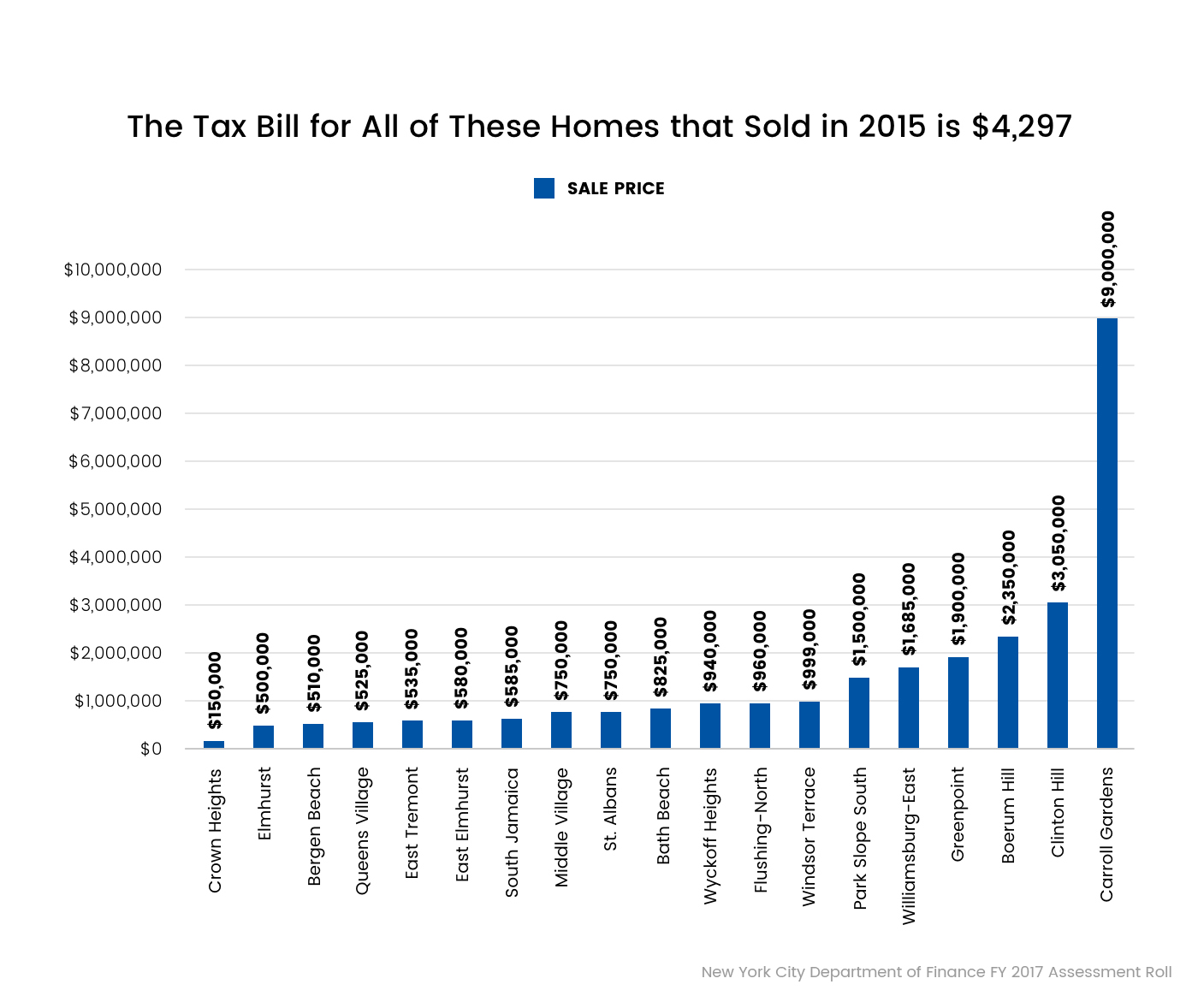

And the below graphic reveals that homes that sold for a wide range of prices are charged the same property tax rate--including a $9 million property in affluent Carroll Gardens and a $150,000 property in the gentrifying, but considerably less wealthy Crown Heights.

Furthermore, David in Crain's points out that condo and co-op owners have long been granted tax breaks, a move originally intended to keep homeowners in the city during the mass migration to the suburbs of past decades. The incentive persists today, though, with a cap of six percent on how much the taxable value of a home in NYC can increase annually.

This places the owners of multi-tenant rental buildings, who don't qualify for this break, at a significant disadvantage, he argues. But whereas taxes on owner-occupied homes are low in NYC, Business Insider explains, multi-tenant rental properties are taxed at twice the national average. Tenants who aren't rent-regulated, then, may face rising rents to make up for their landlords' property taxes--or those landlords might skimp on building maintenance in order to recoup their property tax losses.

The goal of the lawsuit, SI Live reports, isn't to pay back those renters and homeowners disproportionately burdened by this method of calculating property taxes, but rather to compel the city to reform the sytem on the grounds that it's unconstitutional. In response, the Real Deal writes, De Blasio has promised he will take on reforms of the complicated tax code—if he's re-elected to a second term this November.

You Might Also Like