The two most beautiful words a mortgage applicant can hear

At this point in my apartment-buying career—and yes at times it has felt like a full-time job—I began coming around to the idea that hope looks through a blind eye.

With so many obstacles in my way, should I give up? Or was that purchase just around the corner? Or a phone call away?

After the Wells Fargo debacle--and upon the advice of Sidney, my real estate agent--I called the local branch of Mortgage Master, a privately owned direct lender with access to more flexible loan products than what commercial banks can offer.

I was assigned by phone to Peter, a loan specialist, who took in my details, clucking sympathetically at various points. He ran my credit report while we were on the phone. I held my breath: with so many inquiries into my credit the past six months, my score had dropped a few points, even though I had taken out no new credit or ever had a late payment.

Apparently none of that mattered.

“We can get you a better loan with better terms,” he said.

Peter recommended a state-sponsored loan program for first-time buyers, appropriate for mid-income earners and people like me who were freelancers with steady income. I would qualify for a better interest rate than at a big bank, and the closing costs would be substantially lower, too. I wondered why Wells Fargo (which was on the list of approved lenders for these first-time buyer loans) had not recommended such a loan. And, I cursed myself for not doing my homework.

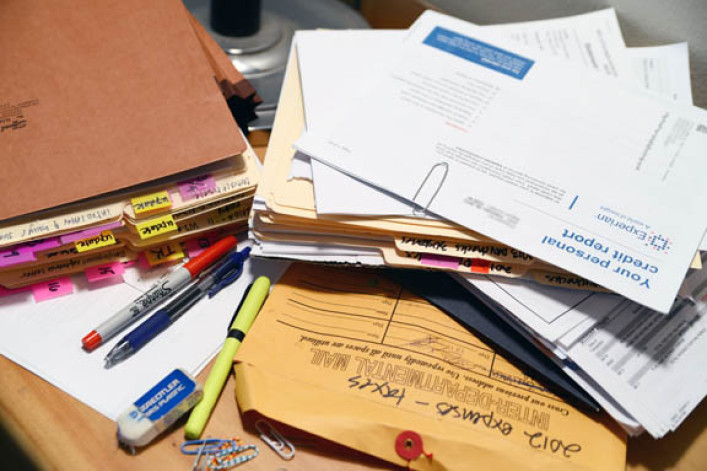

Peter instructed me on initial documentation—two years of tax returns and bank statements to start with. It was beginning to feel like Groundhog Day, the movie. Again.

Then he dropped the news I dreaded.

“You’ll have to get your 2012 taxes in on time," he said.

It was March 26 and I had already filed for extensions, as was my usual custom. My accountant wouldn’t have me on his schedule for filing on April 15. And if by some miracle he could fit me in, I’d have to pull all-nighters organizing my receipts and creating spreadsheets. But, seemingly, I had no choice.

The first call I made was to my CPA, a grouchy, high-strung guy who had a bit of car salesman in him. As expected, he flew off the handle. Bad timing, he said. But if I could get my paperwork done by April 2, he would try to get me on the schedule.

I had several hard and fast work deadlines I couldn’t negotiate, but if I cancelled all social commitments, all non-essential events, I could crank out the spreadsheets.

I set to work in shifts: two hours of sorting receipts, two hours of assembling documents for the lender. My attorney requested another extension on the commitment letter. Sidney went on vacation. I wore down the cushion on my desk chair a little more, and the take-out food containers filled the recycling bin for the three days I stayed put and punched out numbers.

A few days later, I found out I was a victim of my own success. Declaring the income required for the loan would cost me nearly $16,000 in taxes. Again. That was several thousands of dollars more than the result of some creative accounting. When I combined that with last year’s declaration, I figured it was costing me nearly $20,000 extra to qualify for a mortgage—and I wasn’t getting an apartment that was $20,000 better.

It was costly to move forward, but it was costly to back out.

On the plus side, the 3% interest rate on this mortgage was less than the 3.625% I had almost gotten at Wells Fargo. And closing costs were now estimated at $3,000 versus $6,680. I had to hope that my investment would eventually pay off.

Mortgage Master fed me a steady stream of paperwork over the next couple of weeks while my attorney and I worked other documentation—appraisals, Aztec agreements, title searches. By April 19, my taxes were filed, my application was complete, and I set out to deliver the package to my lender at his Williamsburg office.

I stepped into a reception area with exposed brick walls and the trimmings of Brooklyn’s industrial-chic vibe—vintage prints, old warehouse machinery and flea-market object. I felt at ease. Even Peter, the hipster specialist on my loan, exuded confidence. He flipped through my application, directing me where to sign.

"Looks good," he said at the end.

I had heard that before.

“Are you sure? “I asked. “Like, how good? Can I pick out paint chips?”

He smiled, slapped the stack of papers and said, “Pick out your paint chips.”

Next up: Closing in on the deal

Elle Bee is a lifelong renter currently in the process of buying a Brooklyn apartment, recounted in her bi-weekly column, Diary of a First-Time Buyer.

Related posts:

With Brooklyn behind me, I head toward Hudson Heights

My Big Fat Board Interview column

What I learned from 150 apartments before I finally bought one

Here are 7 things your lawyer should tell you when you buy a condo or co-op in NYC (sponsored)

A single guy reveals why he took the co-op plunge -- and how he basically lives for free

Unraveling NY real estate spin--one white lie at a time

To pass your co-op board interview, read this first

16 things I wish I knew before buying this place

A NYC real estate lawyer reveals the 14 biggest surprises for first-time buyers (sponsored)

Confessions of a preconstruction buyer

The 7 worst places to live in a building

Your next place: 9 questions that separate the New Yorkers from the rookies