PropertyShark QuickTip: See how your property taxes stack up against your neighbor's

QUICKTIP: In need of a reality check on whether you're paying too much in property taxes? Or have your eye on a new apartment and wondering how it compares? Find out with real estate website PropertyShark. Start by typing the address into PropertyShark to bring up a detailed property report ($9.95 each, or $39.95/month for 150 reports a month).

If you're looking up a condo, single-family home or building, you'll see the last five years of tax history in Section E: Property Tax. Now click on the Find Comparables tab at the top to see if nearby, similar properties have significantly lower taxes. For co-op units, whose property taxes are folded into maintenance fees, compare the building's overall property tax bill to similar nearby buildings using this interactive map.

Above, the tax history of a single-family home in the Bronx.

Here are a few tips and tricks to make your search go smoothly, via PropertyShark real estate data specialist Nancy Jorisch:

Search for comparables by map: In addition to using the Find Comparables, you can scroll up to Section A8: Maps. Click there to pull up a larger map with a mini-report that includes building and lot size, square footage and number of residential units. Then click on nearby properties to pull up their mini-reports.

“The map is useful because you can more easily tell if the property’s on a corner or opposite something commercial,” says Jorisch. “If the apartment is on a loud, busy street and a nearby, similar apartment with lower taxes is on a quiet block with a park, you might be able to make a case for lowering the taxes.”

Condos vs. co-ops: For condos and single-family homes, tax info on individual units is readily available as unit owners pay taxes separately from common charges.

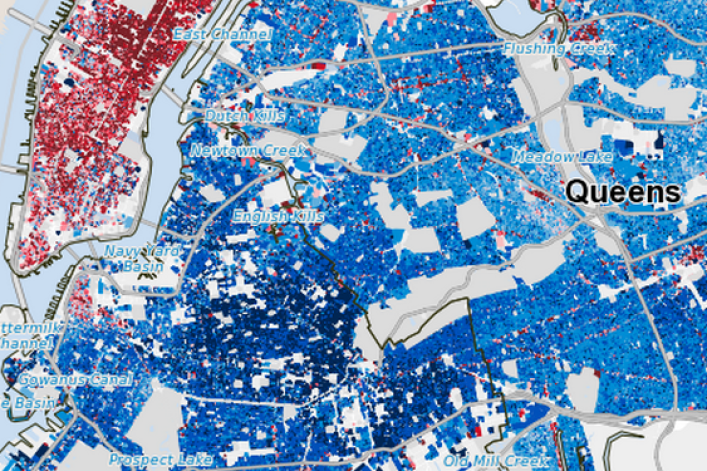

It’s a little trickier if you're looking up a co-op, since monthly maintenance fees include the unit’s share of property taxes plus other fees required for running the building. You can see the tax information for the building as a whole, but not the individual units. To get a sense of how the building fits into the local property tax landscape, take a look at the Tax Value per Square Foot map (below).

Shades of red represent properties with higher values (with maroon being the most expensive at above $10 and light pink being the least at $5-$6). Shades of blue have lower values per square foot, with light blue denoting places with a $4-$5 value and navy blue meaning below $1.

“It’s the easiest way to compare taxes for nearby co-op buildings,” says Jorisch.

Would you be exempt too? You can also use Section E2: Exemptions and Tax Abatements to see what tax exemptions the current owner of the property has. But remember, many tax exemptions are specific to the individual (such as if you’re a veteran or a senior citizen or based upon your income), so you need to determine if it would apply to you as the owner.

Learn your post-abatement rate: If you're thinking about buying a new or newish condo with a tax abatement in place, Jorisch advises pulling up reports for comparable properties to check their tax rates to get a clearer sense of what your tax situation would look like once the abatement ends. “Remember, abatements can be hugely beneficial,” she says. “But they’re only temporary.”

PropertyShark.com is a real estate website that provides in-depth data for more than 75 million properties in New York City, Philadelphia, Los Angeles, San Francisco Bay Area, and other major U.S. markets. The company covers most of the U.S. with a primary focus on the New York real estate marketplace. Click here to see what services and data are offered in your area.

More from PropertyShark.com:

QuickTip: How to check for liens before you make an offer (and why you should)

How to buy an apartment that's not for sale

How to find the real owner behind an LLC

3 more ways to find the real owner of a NYC property

Map of the Month: Toxic sites in New York City

Map of the Month: See every co-op and condo with a parking garage in NYC