The 5 least safe places to live in your building .. and how to stay safer everywhere

When BrickUnderground set out to answer the question “What are the safest and least safe places to live in a building?” we went directly to our expert on security matters, Harry J. Houck, President of Houck Consulting, Inc and a retired NYPD detective.

According to Houck, because of their easy access (and in some cases their hidden nature), these are probably the least safe places to live in a building:

- A first-floor apartment that can be accessed from the lobby

- An apartment with a window within 18-feet of the ground

- An apartment with a fire escape

- An apartment below ground level

- An apartment facing the back of the building (because it's out of plain sight)

But, according to Houck, the most important point to

keep in mind is

that no matter where you choose, preventing burglaries is in many cases “up

to you.”

The most common mistakes

As surprising as it may seem, most burglars get into

an apartment through an unlocked front door or an unlocked window, Houck says.

They don't pick locks.

Many people just leave their doors open. They say “

I've got a doorman—why do I need to lock my door?”

That's a

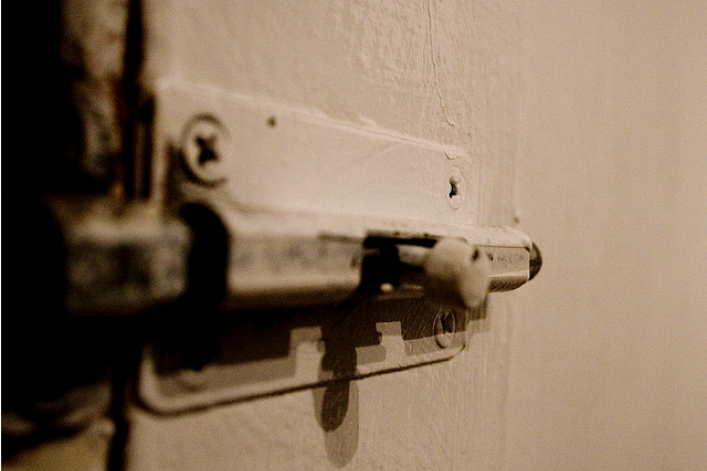

foolish assumption. Houck says that if you have a dead-bolt lock that's actually

locked, there's a slim to none chance that you'll be burglarized.

It's tempting to leave windows open when it's warm

but if you are on the first floor, or you have a fire escape at your window,

don't do it. Burglars don't break windows—it makes too much noise—they just

look for open or unlocked windows.

If you do have a fire escape, be sure to have an

FDNY-approved gate on it—the Department posts a list of recommended models on

its website.

Another important piece of advice is to keep careful

control of your keys. Avoid giving your keys to too many people—the dog walker,

the plant waterer, etc. Don't leave your keys on the table when someone comes

in to do work in the apartment.

And, when someone comes in to paint, do plumbing,

clean the carpets—anything at all—don't let him or her wander around the

apartment. There are people who will pay people like this for useful

information on where you keep your money, your jewelry, your silverware. And

everyone should have a safe. You can get an inexpensive one for $200.

People who have to be away from their apartment for a

long time might want to consider the equivalent of a “nanny cam” that lets you

see what’s going on in all rooms via your computer wherever you are in the

world.

How the NYPD can help

Although it is not widely publicized, the NYPD offers

a free crime prevention service to all NYC apartment dwellers, owners or

renters. A trained Crime Prevention officer from your local precinct will

come to your home, conduct a security survey and make recommendations for

any improvements that he/she thinks are necessary.

All you have to do is to call your Precinct's Crime

Prevention Office and schedule a date. If you don't know what precinct you live

in, the NYPD website includes a Precinct Finder feature.

One suggestion the Crime Prevention officer will make

is to register your portable valuables—computers, printers, iPads,etc.--with

NYPD's Operation Identification project.

The PD will lend you an engraving tool so that you

can etch a serial number onto your valuables. That number will be registered

with the PD, making the property traceable. You will be given decals for the

window that say that your property is registered, a deterrent to any would-be

burglars.

Just in case: Some insurance advice

Renters or owners insurance is a good way to avoid a

problem later on. Jeff Schneider, of Gotham Brokerage, explains that there are strict limitations on

the type of property that is covered under various policies read your policy

closely.

Often clothing, furniture, art work and electronic

devices are covered in a basic policy but jewelry, furs and silverware are

separate categories requiring additional coverage. If you have a home office

with expensive equipment, that too, may require a separate policy.

To decide how much insurance you need, take an

inventory of what you have. Don't underestimate the value of your clothing.

Schneider says many people make that mistake and realize it only when it comes

time to replace it.

He suggests keeping a record of all significant

purchases so that if there is a loss you can document it, speeding up the

reimbursement process. Take photos of what you have, and save credit card

statements when you buy something new.

When purchasing a policy determine whether you want

to have one that pays the actual cash value of replacing what you had or the

depreciated value. The former will be about 20 percent more expensive.

A basic policy with $15,000 to $20,000 of coverage

will cost from $100-$150 per year. To find the best agent for you, Schneider

recommends getting a reference from a friend, someone who has had a claim

handled satisfactorily.

Related posts:

8 questions you MUST ask before buying renters' insurance (Sponsored)

3 moving scams you should now about -- and 10 ways to avoid getting duped

Everything you need to know about renter's insurance

Dear Ms. Demeanor: Buzzing up a potential burglar just to be polite

So your nanny has sticky fingers. So long -- or so what?

Valuables lesson: Where NOT to hide your stuff from a burglar