Why "average" numbers don't tell the whole story of NYC apartment prices

Unless you're a mega-millionaire, at some point, you've probably found yourself panicking over the latest round of market reports indicating dizzying new numbers for New York City rental and sales prices. ("The average Manhattan rental costs more than $4,000/month?!")

But while there's no denying that the cost of living here is almost incomprehensibly expensive, these sky-high average numbers aren't always telling the whole story. And in fact, they might be making things seem even worse than they really are.

The reason for this can be found in most middle school math classes: Using "average" to measure real estate prices makes it more likely that your numbers can be skewed by extreme outliers at the most expensive end of the market. (Even if the majority of apartment sales in the city go for well below $10 million, add one $250 million condo sale to the mix and the numbers will get thrown way off.)

"Using 'average' can be misleading in a lot of cases," says StreetEasy economist Krishna Rao. "Especially in New York, you have some really extreme sales that go for five or 10 times more than the typical apartment. So if you go with average, you'll see these spikes that represent one or two crazy sales. We prefer to look at median prices to track how the typical market is moving."

Since the median number is the middle point of a set of numbers, it's less prone to dramatic fluctuations based on one or two extremes. "I rely on median rent more than any other metric," concurs Miller Samuel appraiser (and Douglas Elliman data guru) Jonathan Miller. "Average is easily impacted by sudden changes in the mix of what sells, whereas it's harder to move the needle with median.

Still, median prices are also subject to skew. If you have eight $50-million transactions in a quarter, and 50 $35-million transactions, that median starts to edge higher. And that's what we've seen happening in the last couple of years."

Additionally, warns Miller, when markets begin to fall, the median sales prices can actually rise for a while, since cheaper, entry-level transactions are usually the first sales to dry up during a market slowdown. "You have fewer lower priced sales, and then the median rises [even as the market is actually falling]," Miller explains.

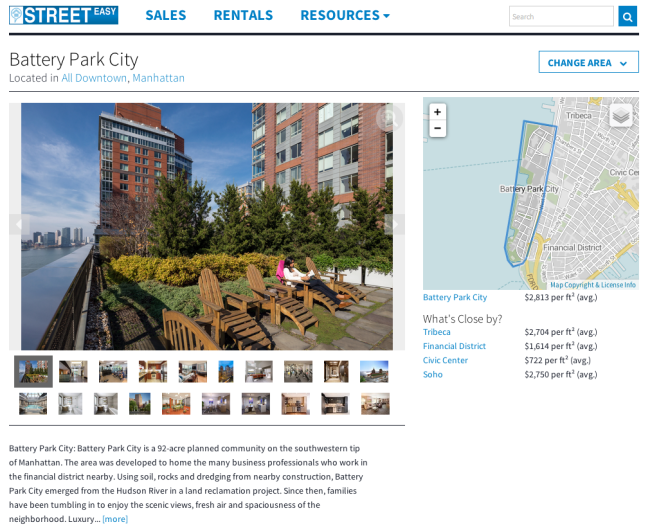

Price-per-square-foot can be a useful added metric for assessing true value, on top of average and median. "For instance, with micro-apartments, they look like a bargain, but on a price-per-square-foot basis, in some cases there's actually a 50 percent premium over other things in the same neighborhood," says NeighborhoodX founder Constantine Valhouli.

But there, too, you run into problems, as the price-per-square-foot can be thrown off by high-end amenities or outdoor space in the building. And, Miller notes, it can be a somewhat opaque number to consumers who aren't hardened real estate obsessives. (When was the last time you casually described your rent or mortgage in terms of price-per-square-foot?)

For this reason, says Miller, "I don't believe in having one holy grail housing price metric. It just doesn't exist." Instead, to get an accurate sense of the market, it's best to look at average, median, price-per-square foot, and more importantly, search for the numbers that specifically relate to what you're searching for. (This means if you're looking for a one-bedroom rental in Bed-Stuy, just looking at the blanket Brooklyn rental cost—whether it's median or average—isn't going to tell you what you need to know.)

"In some reports, they're blending together studios, one-bedrooms, two-bedrooms, three-bedrooms, even townhouses," says Valhouli. "And why are we blending together co-ops and brand new rental developments? And even within the same neighborhood, one two-bedroom might be a barely divided one-bedroom, and another might be in a house with six rooms and a back yard."

If you want to get a sense of the market as it relates to you, you'll want to get a whole lot more specific. Valhouli advises looking "by neighborhood and size, then break[ing] that up into co-op, condo, and townhouse. If something says the average rent is $3,000/month in Queens, what are we talking about? Are we comparing a house in Douglaston to a condo in Long Island City? Because that's not fair."

Ultimately, says Rao, going with the average "can be an attention grabbing way to look at the numbers, but you can kind of fool yourself—it's so high because of how you're calculating."

Adds Rao: "New York real estate is expensive enough as it is. There's no need to use numbers to make it look more expensive."

You Might Also Like