About time: Now you can insure your renovation

Whether you want to retile your bathroom or take on a major gut rehab, renovating in New York City is never fast, simple, cheap or trouble-free.

"Anytime anyone does construction, it’s always so risky,” says John F. Grubin, a partner at Wasserman, Grubin & Rogers, a Manhattan-based law firm that specializes in construction law, commercial litigation and government contracts. “There are always problems."

Enter renovation insurance, an intriguing new product rolled out in November by a company called Bolster.

“We are enabling homeowners to protect themselves against the common problems associated with renovating that often cause irreparable damage to a project or a huge financial loss to the homeowner,” says Fraser Patterson, the founder and CEO of Bolster.

Specifically, Bolster's renovation insurance covers misuse of project funds (say, your contractor absconds with your 30% down payment or applies it to another project), the cost to fix shoddy workmanship, money that the contractor fails to pay to subcontractors or suppliers, and the cost to complete a failed project including replacing the contractor to complete the work.

Since Bolster launched in early November, customers have been setting up projects ranging from as low as $5,000 up to seven-figures, says Patterson, and the first policies will be written in the next few weeks.

How it works

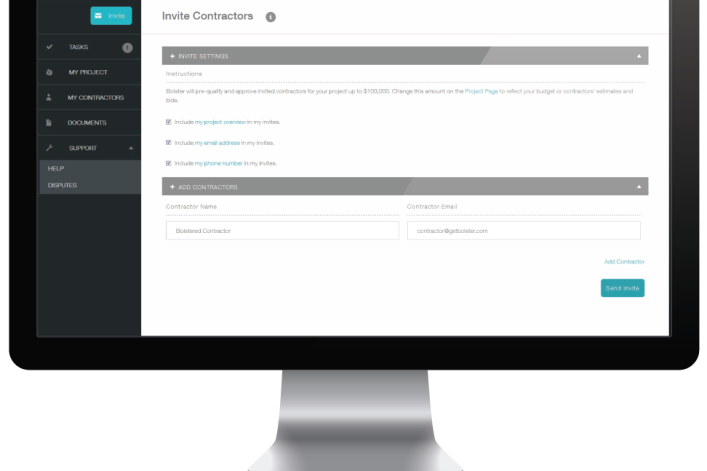

Once you decide that you want to renovate, go to the Bolster website and create an account. You'll be asked to invite contractors to bid on your project. For now, these are contractors that you've found through other means, though eventually Bolster will have a robust database of approved contractors in the system.

Bolster vets the contractors on your list, checking their financial strength, technical competence, management and experience working on similar projects. Bolster also does a full litigation check on the company and the principals. About 65-75% of contractors will not meet Bolster's standards for insurability, says Patterson.

Next you can compare bids and decide who you want to work with. (You can always get a quote from more than one person.) Within 48 hours of making your selection (and once they're approved by Bolster), Bolster will provide you with the cost of insuring your project, which is typically around 5% of the total construction cost, though it can be as low a 3.5% depending on how highly a contractor scores on the company's background check.

You can then finalize the scope of the work, review the contract--which Bolster also provides--sign the terms and conditions, and activate your coverage.

Michael Daryani, a project manager with S.M. Zako, a family owned and operated contracting business that focuses on residential work in Manhattan, has worked on a number of Bolster projects during the company's beta phase of testing this year, including a $50,000 basic renovation in uptown Manhattan,

“It’s a nice idea, especially for people who are not educated or experienced with the renovation process,” he says, noting that hiring a vetted contractor is better than just “plucking somebody off the street."

"I look forward to growing with it," he adds.

With coverage in place, you and your contractor move forward with the project. Bolster’s app and website guides you through the process from start to finish according to best practices, which is advantageous for the architect, too, according to Mary Burke, an architect who own a small design firm in New York City.

“This is a wonderful thing in educating a client,” she says, noting that in residential work, many people don’t understand the basics of contracting and design, which can lead to a lot of hand holding.

Bolster says that its system, which lays out exactly how the process works, also provides structure and transparency, forcing the architect, contractor and homeowner to be on the same page.

“You’re really making a more literate client,” Burke says, adding that the “more educated the client, the better off the process is.”

What happens if a problem occurs on your job

Because Bolster’s insurance is in the form of a performance bond on the contractor, the primary responsibility to fix problems remains with the contractor. If a contractor does not make things right when given the chance, you can file a claim on Bolster’s website. You will then be assigned a customer service representative, who will help with the claims process.

Bolster's insurance partner will investigate the claim, just as GEICO or State Farm would, and if it’s not an option for the original contractor to complete the work, the insurance partner will settle the dispute with you within 60 days, either hiring a new Bolster-approved completion contractor to finish the job or paying out a cash sum.

Is it worth it?

Architect Burke likens the Bolster system to a warranty provided by a well-known consumer electronics and computer brand.

“It’s kind of like getting Apple care for your renovation,” she says.

Grubin, the lawyer specializing in construction (who is not associated with Bolster), tells BrickUnderground that the system “sounds wonderful" if it all works as outlined.

“But the fact that you have this arrangement doesn’t mean that the contractor and the owner aren’t going to get into disputes,” he cautions.

While it's true that a contractor is more likely to behave, Grubin says, and be more careful in the first place, "it's not going to stop owners from being dissatisfied with what happens,” especially if Bolster sides with the contractor if there is a dispute.

He sees the system as an overall positive though, as Bolster gives the homeowner “an easier remedy than immediately going to court,” he says.

Related posts:

How to turn around a renovation turndown

Ask an Expert: Is my contractor overcharging me for insurance?